tax credit survey social security number

Our team has 60 years of combined domain knowledge and development of industry best practices for maximum tax credit generation. WIReturn Integrity Compliance Services RICS Refundable Credits Examination Operations RCEO Toll-Free.

Employment Insurance Ei Benefit Statement Canada Ca

Taxpayer Experience Survey formerly Market Segment.

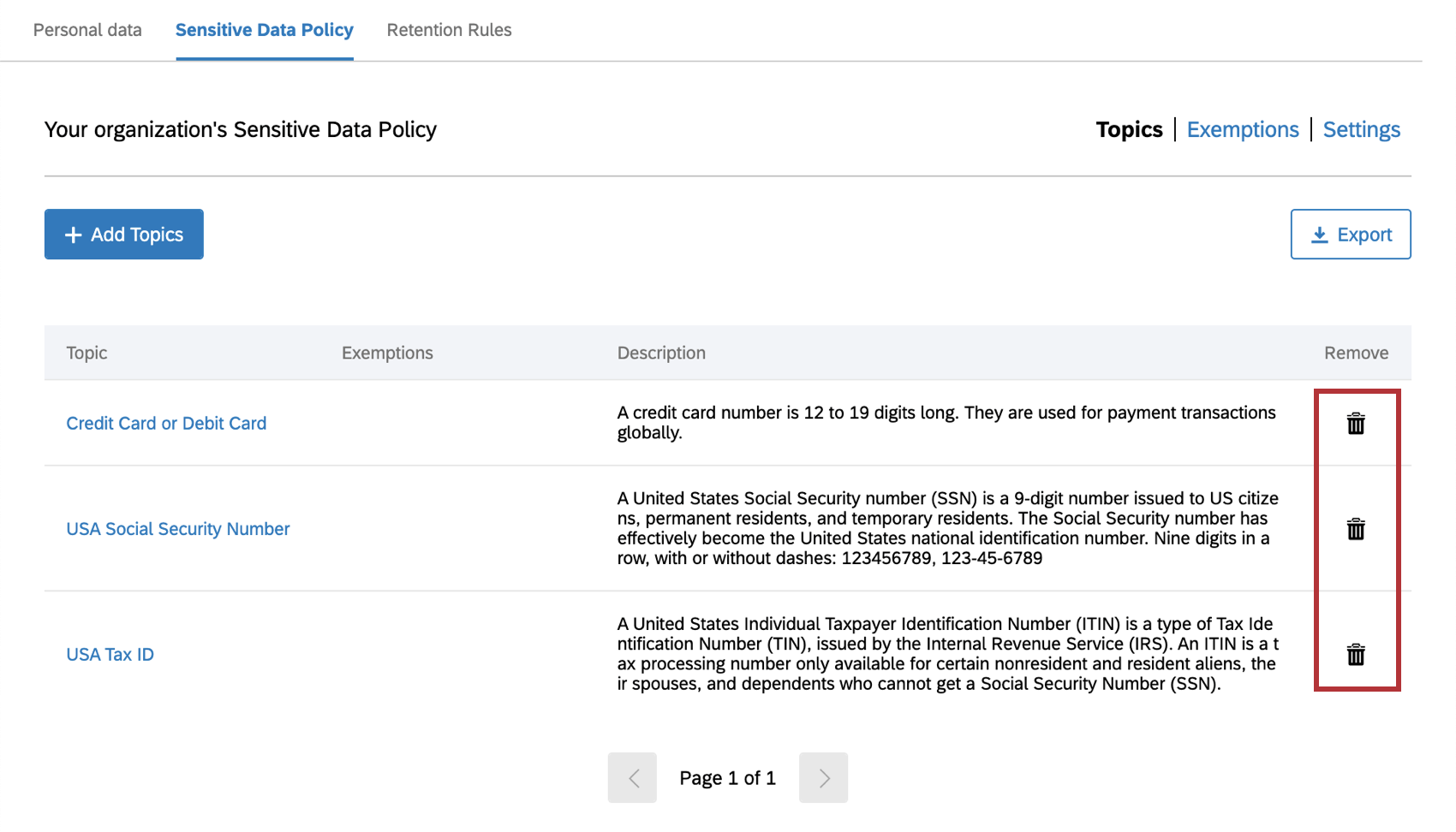

. Here are the forms that should not include social security numbers. Employers organizations or third-party submitters can verify Social Security numbers for wage reporting purposes only. The forms require your identifying information Social Security Number to confirm who.

Forms 990 990EZ 990N-and 990PF the annual returns for charities and private Foundations. Apply for an extension using Form 4868 Application for Automatic Extension of Time To File US. Social Security offers three options to verify Social Security numbers.

Forms 8871 and 8872 filed by. Form 5227- filed by split interest trusts. You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year.

Read our full guide on W9s and online survey taking if youd like to learn more. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups. Individual Income Tax Return.

For Individuals this is your Social Security Number SSN. The company and their website is legit. You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year.

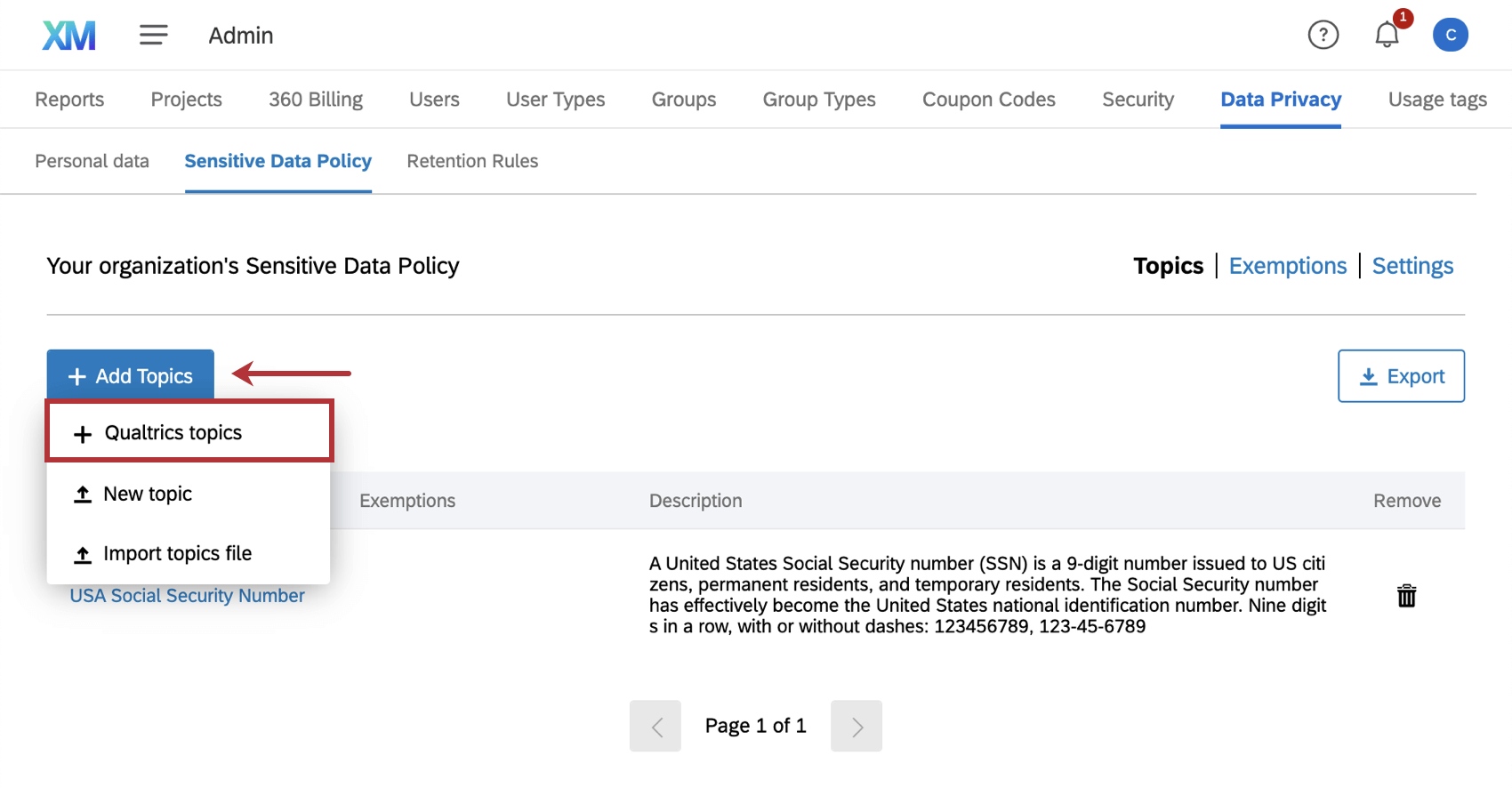

A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit.

Do you have to fill out Work Opportunity Tax Credit program by ADP. I dont feel safe to provide any of those information when Im just an applicant from US. Its asking for social security numbers and all.

It asks for your SSN and if you are under 40. Refundable Credits Examination Operations RCEO Ongoing. From the research Ive done its apparently used to see if I would gain the employer a tax credit working for them but I am very hesitant of providing them my SSN without having a job offer.

I also thought that asking for a persons age was discriminatory. Encourage them to sign and submit IRS Form W-4V directly to their local Social Security office. Im trying to apply for a part-time retail job over the summer.

Electronically file the return without the dependent and then file an amended return after receiving the ID number or. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and. The form will ask you for your personally identifiable information full name address etc as well as your SSN.

How To Get A Credit Card Without A Social Security Number Credit Cards Us News. A taxpayer should continue to use their social security number to pay their estimated taxes once it has been issued even if it is not valid for employment or no longer valid for employment. The Social Security Number Verification Service - This free online service allows registered users to verify that the names and Social Security numbers of.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box this one from a new hire. This is strictly for tax purposes only and is the only time when it is acceptable to provide a research company with your social security number. Fors Marsh Group LLC.

Its asking for social security numbers and all. Street Address 1 Street Address 2. Department of the Treasury to help businesses and individuals pay their federal taxes electronically.

Once you are issued an SSN use it when paying your estimated taxes. City State Zip Code County Parish. IVR Phone phone Mail wonline option FMG.

If you are working with a client who receives Social Security benefits remember that they have the option of federal income tax being withheld from their benefits at the rate of 7 10 12 or 22 percent. Most controversial is the practice of employers asking for social security numbers from every applicant whether the individual will receive further consideration or not. SECNY Member Survey Member Mortgage.

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. Annual tax performance report must be filed by may 31st of the following year.

A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. I dont feel safe to provide any of those information when I. The application asks for my Social Security Number but I feel uneasy providing it this early in the job application process considering that identity theft is on the rise.

Asking for the social security number on an application is legal in most states but it is an extremely bad practice. Your Clients Can Get a W-4V Online. Form 990T filed by charities.

Its a required field on the 2nd stage of an application before doing an interview. I dont just give anyone my SSN unless I am hired for a job or for credit. For most EFTPS Enrollments you will also need.

Some states prohibit private employers from collecting. Employers can verify citizenship through a tax credit survey. If you have applied for and are currently waiting to receive the childs new SSN you may either.

The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are. Questions and answers about the Work Opportunity Tax Credit program. Location Please upload a picture of your drivers license.

Social Security Number Current Phone Number and Address. The Electronic Federal Tax Payment System EFTPS is a service offered free by the US. Forms 1023 and 1024 applications to the IRS for tax-exempt status.

Its asking for social security numbers and all.

Pin On Things That Should Make You Go Hmmm

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

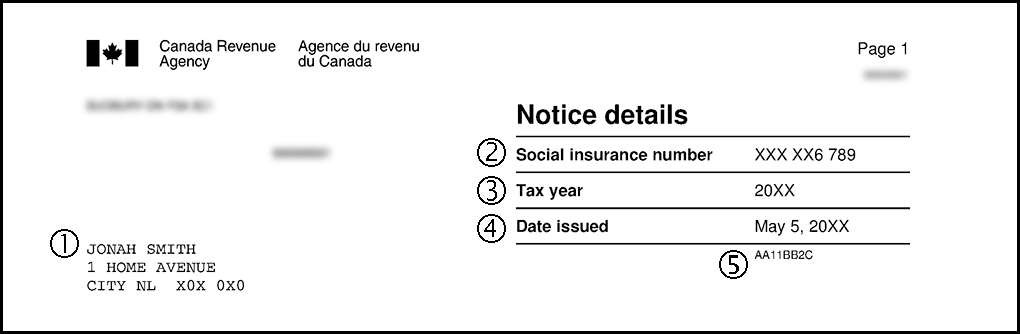

Netfile Access Code Nac 2022 Turbotax Canada Tips

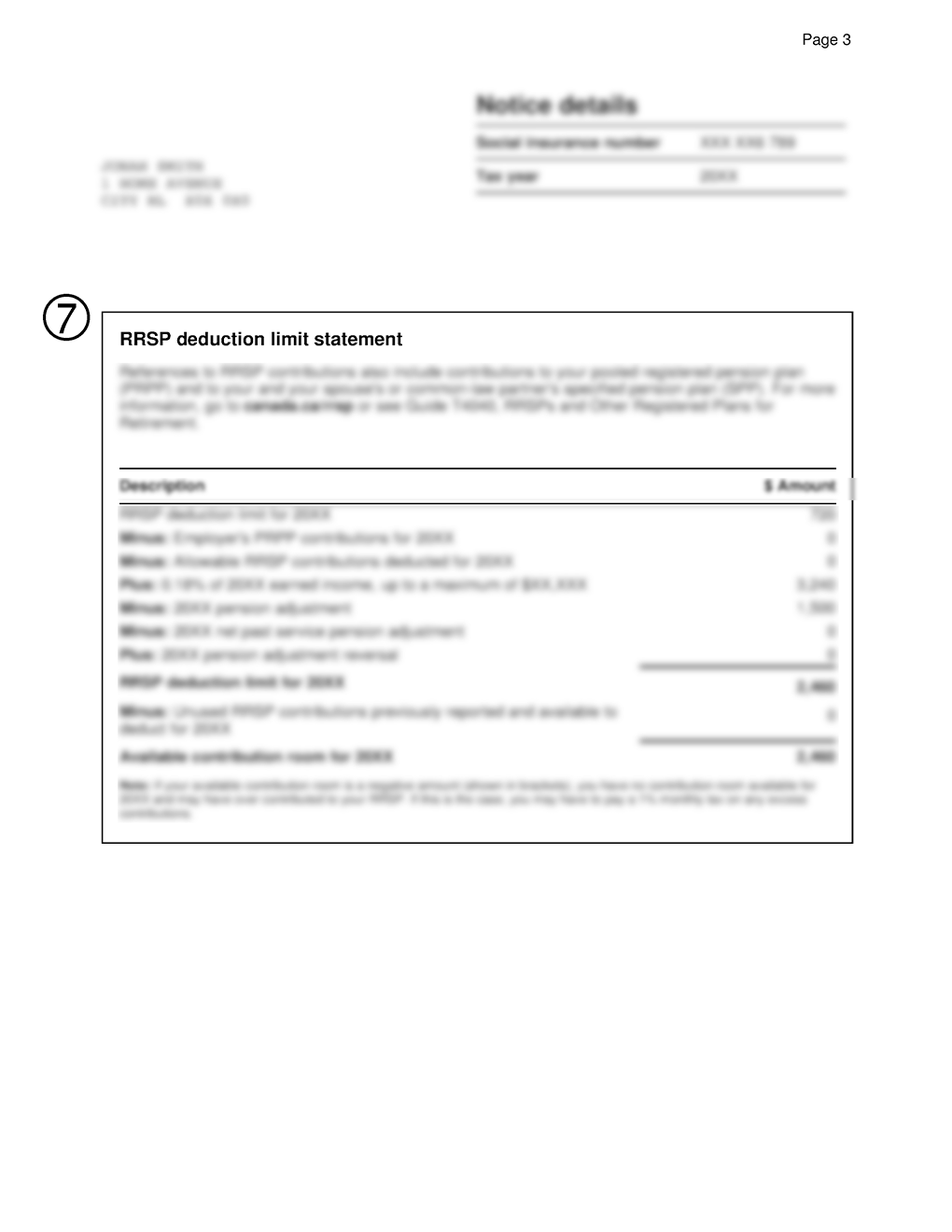

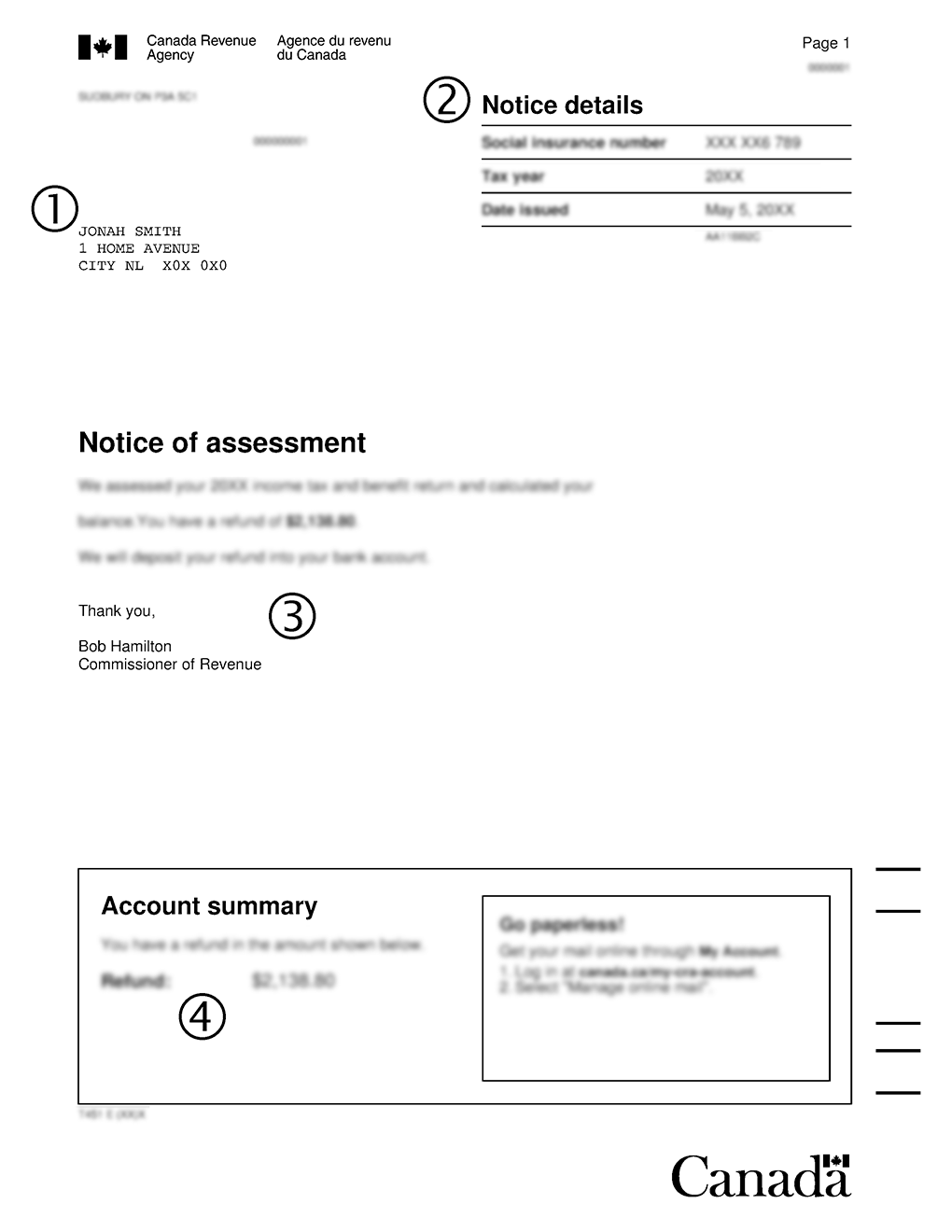

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Credit Application Form 14 Free Word Document Customer Satisfaction Survey Template Engineering Resume Templates

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

What Millennials Really Think About Social Security And Why They Might Not Be Entirely Wrong

Canadian Tax News And Covid 19 Updates Archive

Ncpssm Tax Credits Data Income Tax

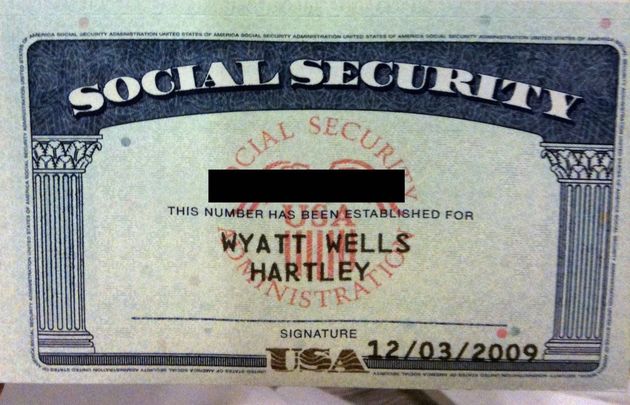

Is My Old United States Social Security Number Still Valid

Work Opportunity Tax Credit What Is Wotc Adp

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

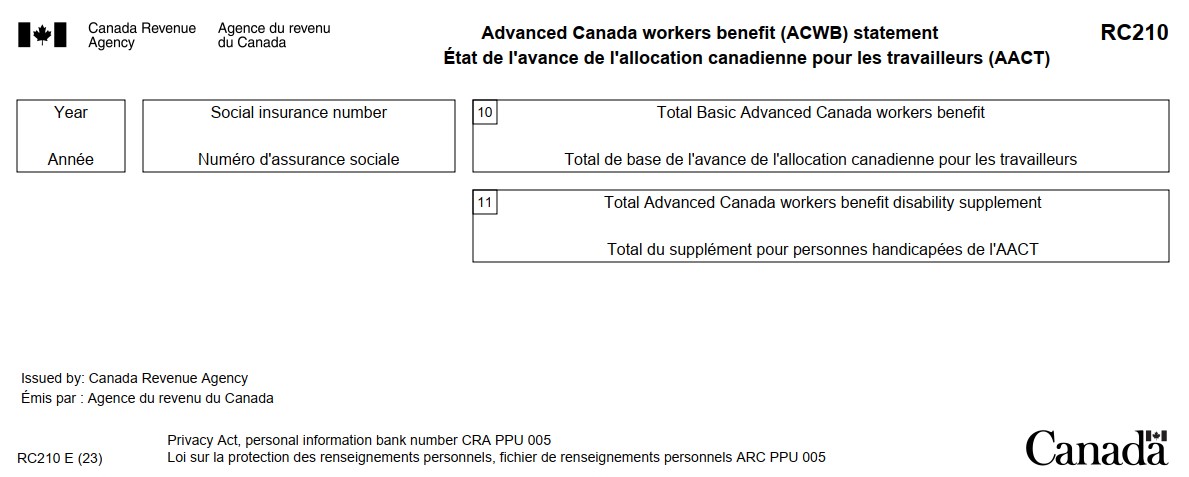

Rc210 Canada Workers Benefit Advance Payments Statement Canada Ca

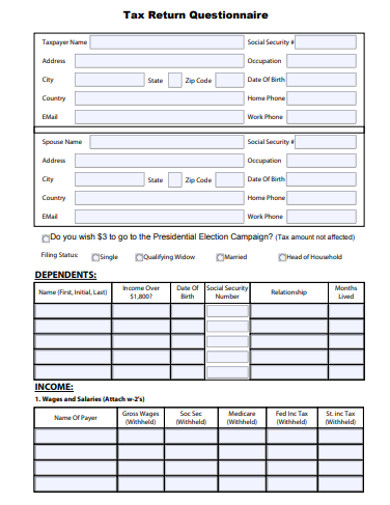

12 Tax Return Questionnaire Templates In Pdf Ms Word Free Premium Templates

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Asking For Social Security Numbers On Job Applications Goodhire